25/04/2025

(TBTCO) - Experts assess that Vietnam's economic outlook for 2024 is forecast to be positive, with GDP growth expected to range from 5.5% to 6.5%, putting Vietnam in the Top 20 fastest growing economies globally. In addition, FDI inflows into Vietnam reflect strong growth, demonstrating investors' strong confidence.

Investment picture in the Asia Pacific region

According to the Savills APIQ report for the first quarter of 2024, investment sentiment in the Asia-Pacific region is cautiously optimistic. Despite rising borrowing costs, wider bid-ask spreads and ongoing global concerns, some bright spots are emerging. Japan, South Korea, Taiwan, Malaysia and Indonesia recorded increased investment activity in the first quarter, while India's industrial/logistics, data center and life sciences sectors are booming.

Asia-Pacific commercial real estate market overview remains weak in Q1/2024. Preliminary estimates show that the region's total investment value (transactions worth over USD 10 million, excluding projects under development and pending transactions) decreased by 18.6% to USD 27.7 billion in the first quarter.

Although interest rates are expected to be cut in most Asia-Pacific markets after mid-year (except Japan and China), interest rates are unlikely to return to 2019 levels in the short term. Higher borrowing costs, wide bid-ask spreads and persistent global challenges remain key factors weighing on investor sentiment.

Overview of Investment in Vietnam Q1/2024. Source: APIQ Savills

In contrast, despite the slowdown in investment activity compared to the previous quarter, investors remained bullish on the Indian real estate market. While many may postpone commitments until after the elections, there was steady interest in commercial office and industrial/logistics assets, buoyed by the positive economic outlook.

The industrial sector performed strongly compared to other asset classes in Q1 2024, driven mainly by logistics, cold storage and data centre transactions.

Notably, data centre investments recorded impressive growth, exceeding US$1.5 billion, a three-fold increase compared to the same period last year.

Mr. Simon Smith - Head of Research and Consulting, Asia Pacific at Savills analyzed that in the Asia-Pacific region, higher borrowing costs, large price gaps and persistent global challenges are still the main factors hindering investment sentiment.

However, some bright spots still exist as Japan, South Korea, Taiwan, Malaysia and Indonesia all recorded increased investment volumes in the first quarter. In addition, demand for industrial/logistics real estate, data centers and social sciences in India is also increasing strongly.

Strong investor confidence

The Asian Development Bank, the International Monetary Fund (IMF) and the World Bank forecast Vietnam's GDP growth in 2024 to reach 5.5% to 6.5%. According to the IMF, Vietnam will be one of the fastest growing economies in the world by 2024, on par with countries such as Macau, India and the Philippines.

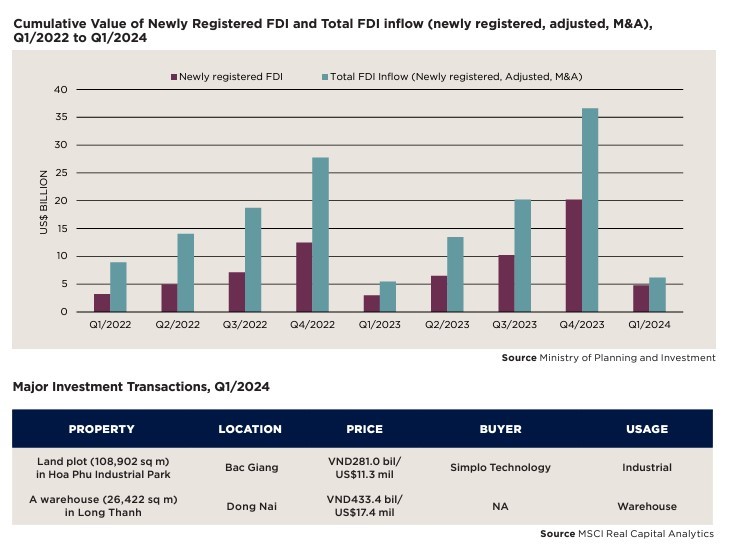

Mr. Troy Griffiths - Deputy Managing Director of Savills Vietnam assessed: “Vietnam's economic outlook for 2024 is forecast to be positive, with GDP growth expected to range from 5.5% to 6.5%, placing Vietnam in the top 20 fastest growing economies globally. FDI inflows into Vietnam reflect strong growth, with newly registered FDI capital increasing by 58% compared to the same period last year, showing strong investor confidence, especially in some vibrant industrial sectors”.

With newly registered FDI capital increasing sharply, showing strong investor confidence and a vibrant industrial sector. Photo: T.L

The APIQ report forecasts that Vietnam's semiconductor industry is expected to attract significant investment in 2024. Vietnam will benefit from the CHIPS and US Science Act, which includes a $500 million grant to improve semiconductor training, cybersecurity, and the global business environment. Lam Research (USA), a leading semiconductor manufacturer, plans to build a factory with a total investment of $1 to $2 billion.

In the industrial sector, Gelex Group and Frasers Property are collaborating to build LEED-certified industrial parks. They recently broke ground on the Yen My Industrial Center Project (Hung Yen), which will provide 159,000 square meters of flexible factory space.

In addition, the Dong Mai Industrial Park (Quang Ninh), which includes a 71,000 square meter ready-built factory, is expected to be completed in the fourth quarter of 2024. Becamex IDC Corp has just signed an investment agreement for the 5,000-hectare Binh Thuan Industrial Park project with a total investment capital exceeding 800 million USD.

In the office segment, strong demand from foreign manufacturing and IT companies will continue to support the office market in Hanoi and Ho Chi Minh City. By the end of 2026, the supply of Grade A and B offices in Ho Chi Minh City is expected to increase by 200,000 square meters, equivalent to an increase of 20% compared to the current level. Hanoi is expected to receive an additional 220,000 square meters, an increase of 13% compared to the current level.

From: Financial Times

Zalo

Zalo Webchat

Webchat